Corporate Governance

Basic Philosophy

Criteria for Determining Independence of Outside Officers

Corporate Governance Structure

Corporate Governance Structure (As of June 30, 2025)

Corporate Governance Report

List of Directors

Message from Outside Directors

Basic Philosophy

The Company consistently pursues optimal corporate governance and is committed to its continuous improvement.

To achieve sustainable growth and enhance medium- to long-term corporate value, we believe that the essence of corporate governance lies in ensuring transparency and fairness in decision-making, effectively utilizing our management resources, and fostering dynamic management through prompt and decisive decision-making.

In line with the following basic principles, we are dedicated to enhancing our corporate governance framework:

1.

Respect shareholder rights and ensure equality.

2.

Consider the interests of all stakeholders, including shareholders, and collaborate with them appropriately.

3.

Disclose company information appropriately to maintain transparency.

4.

Establish mechanisms where independent outside directors play a crucial role (e.g., board composition, nomination, and compensation advisory committees) to strengthen the board's supervisory functions.

5.

Engage in constructive dialogue with shareholders who have investment policies aligned with the medium- to long-term interests of shareholders.

Criteria for Determining Independence of Outside Officers

The Company determines whether an outside director or outside auditor (collectively referred to as “outside officers”) or a candidate for such positions is independent if they do not fall under any of the following criteria based on reasonable investigations:

①

An executive of the Company or its subsidiaries (“the Group”).

②

A party for whom the Group is a major client or an executive thereof.

③

A major client of the Group or an executive thereof.

④

A major shareholder of the Company (holding 10% or more of voting rights) or an executive thereof.

⑤

A party in which the Group holds 10% or more of voting rights or an executive thereof.

⑥

A person affiliated with the auditing firm serving as the Group’s accounting auditor.

⑦

An attorney, certified public accountant, tax accountant, consultant, or similar professional receiving significant monetary or other financial benefits (as defined) from the Group apart from director compensation.

⑧

A recipient of significant donations or subsidies from the Group, or an executive of such an entity.

⑨

A person serving as an external officer at another company where a Group executive serves as an outside officer.

⑩

Persons who have fallen under the above-mentioned item ① in the past 10 years.

⑪

A person who fell under items ②–⑨ within the past three years.

⑫

A close relative (spouse or within the second degree of kinship) of an individual described in items ①–⑨ who holds a significant position.

1.

Executives: Individuals such as directors, executive officers, operating officers, employees executing operations, trustees, or equivalent personnel of a corporation or other organization, including those who have previously been associated with the Group at any point in time.

2.

Parties for whom the Group is a major client: Parties receiving payments from the Group amounting to 2% or more of their consolidated annual net sales in the most recent fiscal year.

3.

Major clients of the Group: Parties making payments to the Group amounting to 2% or more of the Group's consolidated annual net sales, or those providing loans equivalent to 2% or more of the Group’s consolidated total assets as of the end of the most recent fiscal year.

4.

Significant amount: For individuals, an average of over 10 million yen annually over the past three fiscal years; for corporations or organizations, over 2% of their consolidated net sales or total revenue.

5.

Key personnel: Includes directors (excluding outside directors), auditors (excluding outside auditors), executive officers, and senior employees at the level of general manager or above.

Reference: Basis for Disclosure

Principle 4-9: Independence Criteria for Independent Outside Directors

The Board of Directors should establish and disclose independence criteria for outside directors, ensuring their independence beyond formal standards stipulated by financial exchanges. It should also prioritize candidates who can contribute to constructive and robust discussions within the Board of Directors.

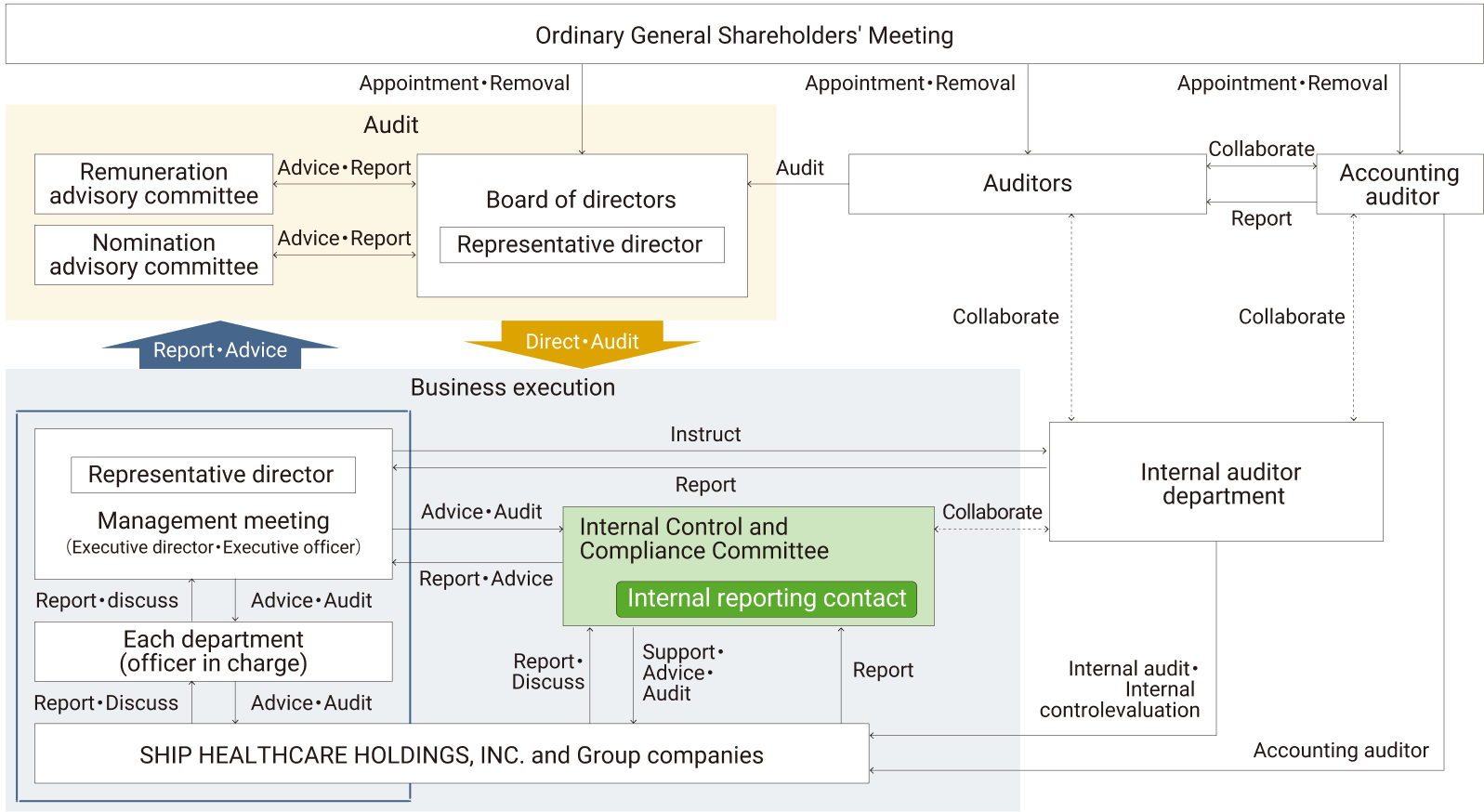

Corporate Governance Structure

The Company adopts an auditing system and has established a Board of Directors and an Audit Committee. Additionally, the Board of Directors is supported by advisory committees, including the Nomination Advisory Committee and the Compensation Advisory Committee.

The Board of Directors consists of 11 members, including four independent outside directors. It convenes monthly for regular meetings and holds extraordinary sessions as necessary. Directors are appointed by business segment and geographic region, such as Kansai and the Tokyo metropolitan area. This approach ensures that directors with specialized knowledge in respective business fields or local circumstances participate in decision-making, fostering an accurate and effective management system.

A flat organizational structure has been implemented, supported by dedicated project teams assembled as needed. This structure ensures clear delegation of responsibilities, rapid decision-making, efficient communication, and streamlined management processes.

Among the 11 directors, four independent outside directors are selected to ensure impartial supervision and oversight of decision-making processes. Furthermore, auditors also participate in the Board of Directors, monitoring decision-making and the execution of business operations.

The Audit Committee comprises four members, including three independent outside auditors. As an independent body entrusted by shareholders, the committee aims to contribute to fair and sound corporate management and enhance public trust. It collaborates with the Internal Audit Office and external accounting auditors to oversee the execution of duties by directors.

The Nomination Advisory Committee consists of six directors, including one independent outside director. The committee reviews and deliberates on the content of proposals regarding the appointment and dismissal of directors and executive officers. Before finalizing such proposals, the committee seeks input from independent outside directors and provides recommendations to the Board of Directors. Additionally, the committee advises the Board on matters concerning independence criteria.

The Compensation Advisory Committee comprises six directors, including one independent outside director. The committee deliberates on policies related to director compensation, including criteria for performance-linked compensation and stock-based incentives. It also reviews the individual compensation details of directors. After seeking input from independent outside directors, the committee provides recommendations to the Board of Directors.

The Management Council deliberates on specific policies and plans for operational execution, as well as other critical matters related to consolidated accounting, based on the basic management policies determined by the Board of Directors. The Internal Audit Office operates directly under the President and serves as a preventive mechanism against corporate misconduct. It conducts audits on the overall activities of the company, including operational effectiveness, accuracy, and compliance with laws and regulations. Based on these audits, the office provides specific advice and recommendations to improve operations. The Internal Control & Compliance Committee convenes regularly to establish and maintain robust internal control and compliance systems. It oversees measures to ensure compliance across the company and promotes continuous improvements in governance structures.

Corporate Governance Structure (As of June 30, 2025)

The Board of Directors includes independent outside directors, constituting more than one third of its membership. Under their supervision, the Internal Control and Compliance Committee, chaired by the Representative Director and President, is established directly under the Management Council to enhance governance across the entire Group.

Corporate Governance Report

The Corporate Governance Report, summarizing the company's governance framework and status, has been submitted to the Tokyo Stock Exchange.

List of Directors

| No. | Position | Name | Particular areas expected by the Company (up to 3 areas) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Corporate management | Industry knowledge & medical policy | Sales & marketing | Finance & accounting | IT & technology | Human resources & human resources development | Legal affairs, risk management & compliance | |||

| 01 | Chairman | FURUKAWA Kunihisa | ● | ● | ● | ||||

| 02 | President | OHASHI Futoshi | ● | ● | ● | ||||

| 03 |

Vice Chairman General Manager, MSP Business Division |

KONISHI Kenzo | ● | ● | ● | ||||

| 04 |

Vice Chairman General Manager, TPP Business Division |

OGAWA Hirotaka | ● | ● | ● | ||||

| 05 |

Executive Vice President General Manager, Secretary Office |

YOKOYAMA Hiroshi | ● | ● | ● | ||||

| 06 |

Managing Director General Manager, Sales Planning Division |

UMINO Atsushi | ● | ● | ● | ||||

| 07 |

Director General Manager, Administration Division |

YASUDA Yoshio | ● | ● | ● | ||||

| 08 | Outside Director | SANO Seiichiro | ● | ● | |||||

| 09 | Outside Director | IMABEPPU Toshio | ● | ● | |||||

| 10 | Outside Director | ITO Fumiyo | ● | ● | |||||

| 11 | Outside Director | NISHIO Shinya | ● | ● | ● | ||||

| 12 | Outside Corporate Auditor | MIZUSHIMA Toichiro | ● | ● | ● | ||||

| 13 | Full-time Corporate Auditor | TODA Narushige | ● | ● | ● | ||||

| 14 | Outside Corporate Auditor | MINAMI Koichi | ● | ● | ● | ||||

| 15 | Outside Corporate Auditor | SANO Nobuyuki | ● | ● | ● | ||||

Message from Outside Directors

SANO Seiichiro

Outside Director

June 2007: President and Representative Director, Sanyo Electric Co., Ltd.

April 2011: Executive Vice President, Panasonic Corporation (now Panasonic Holdings Corporation)

June 2016: Advisor, Panasonic Corporation

June 2017: Director, SHIP HEALTHCARE HOLDINGS, INC. (Current role)

I am now in my ninth year as an outside director of the Company. The Board of Directors at SHIP HEALTHCARE provides a highly conducive environment for outside directors to express their opinions freely. Comprehensive information sharing is conducted in advance for all agenda items, ensuring well-informed discussions.

A critical aspect of corporate governance for the Company lies in understanding the status of its consolidated subsidiaries. Currently, the Board is thoroughly informed about compliance-related challenges in subsidiaries and even countermeasures are deliberated—a commendable approach. Moving forward, it will be necessary to reinforce function of headquarter about the extent to which governance should extend to subsidiaries and sub-subsidiaries operating in diverse business domains.

The Company’s commitment to achieving a consolidated revenue of one trillion yen reflects its proactive stance toward growth, which is highly commendable. I hope the Company to further focus on developing senior management who can drive growth and ensuring young and superior human resources who take responsibility in the future.

IMABEPPU Toshio

Outside Director

July 2013: Director-General, Pharmaceutical and Food Safety Bureau, Ministry of Health, Labour and Welfare

July 2014: Director-General for Policy Planning and Evaluation, Ministry of Health, Labour and Welfare

June 2019: Director, SHIP HEALTHCARE HOLDINGS, INC. (Current role)

On the Board of Directors, I strive to contribute insights based on my extensive experience in healthcare administration and crisis management. My focus is on presenting a mid-to-long-term perspective that extends beyond short-term operational efficiencies. Additionally, I aim to highlight and address any organizational practices that could pose risks in the future. The Board engages in highly enthusiastic discussions and urgent matters prompt the swift convening of extraordinary meetings—a notable strength.

As the Company continues leveraging its strengths for steady growth based on the newly formulated medium-term management plan, I hope the Company maintains its open and flexible corporate culture during the leadership transition from its founding generation to the next

ITO Fumiyo

Outside Director

April 2008: Nursing Specialist, National Hospital Division, Ministry of Health, Labour and Welfare

April 2016: Chief Nurse, National Hospital Organization Osaka Medical Center

April 2019: Manager of Recruitment and Education, Rakuwakai Foundation

June 2019: Director, SHIP HEALTHCARE HOLDINGS, INC. (Current role)

September 2025: Manager of Nursing, Rakuwakai Foundation

On the Board, I aim to provide insights rooted in my experience in nursing, hospital operations and healthcare administration. My contributions prioritize the perspective of delivering value to customers, aligned with the Company's “SHIP” Philosophy.

I am particularly impressed by how thoroughly the Company integrates its management objectives and strategies, based on “SHIP” Philosophy, into its business operations. From a risk management standpoint, attention should extend to disaster preparedness, infection control and unforeseen staff-related incidents, including emerging concerns such as customer harassment.

I look forward to seeing the Company continue its commitment to customer-centric value creation, ensuring quality improvements and developing innovative products and services under unwavering “SHIP” Philosophy.

NISHIO Shinya

Outside Director

April 2016: Executive Vice President, Daiwa Securities Co., Ltd.

April 2018: President, Daiwa Investment Management Co., Ltd.

April 2021: Full-Time Advisor, Daiwa Corporate Investment Co., Ltd.

June 2021: Director, SHIP HEALTHCARE HOLDINGS, INC. (Current role)

Leveraging my experience in the securities industry, I offer guidance on the appropriate direction for the Company, particularly in alignment with the spirit of the Financial Instruments and Exchange Act. I also provide input on the Company’s reputation and other relevant considerations.

The agenda items presented to the Board are well-prepared and thoroughly debated by the execution side, ensuring streamlined deliberations. Additionally, clear accountability and effective internal controls within each department enhance the Company's governance framework. However, I note that some meeting materials are distributed at short notice, an area that could benefit from improvement.

As the Company's business model emphasizes growth through M&A, the integration of “SHIP” Philosophy across Group companies is essential. I hope the Company strengthens organizational cohesion to ensure seamless communication and alignment across its expanding operations